tax benefit rule irs

The IRS or other relevant agency sets rules in place to create a tax benefit that enables individuals or businesses to gain some sort of tax advantage. When you file your 2021 tax return you can claim the other half of the total.

What Is The Tax Benefit Rule The Benefit Rule Explained

The tax benefit rule is straightforward at least on paper.

. This is the law in the United States that makes tax payments a legal requirement and gives the. Instead the IRS argued that the husbands estate had to include income in Year 3 in the amount of the tax benefit he received from his prior deduction for the farm inputs due to the tax benefit. According to the new IRS position if Chris had paid the proper amount of state income taxes in 1991 12000 paid less the 2000 refund the 10000 deduction would have.

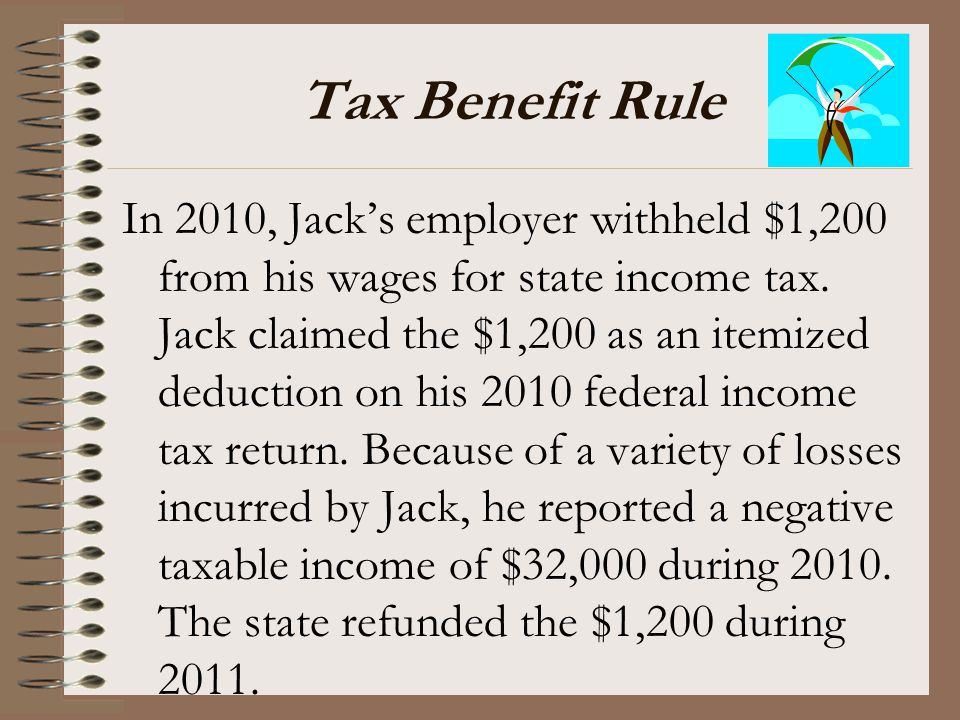

The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. 99514 1812a2 substituted reducing tax imposed by this chapter for reducing income subject to tax or reducing tax imposed by this chapter as the case may be. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included.

Legal Definition of tax benefit rule. 1 day agoThe IRS has released the 2023 cost of living adjustments for limits on employee benefits including qualified plans tax withholding rates high deductible plans health savings. When your children receive adequate educations in well-funded school systems your own quality of life is.

2019-11 issued on March 29 the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be. In some cases tax.

A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the. Children who attend public schools benefit from 47 of tax dollars collected. If a taxpayer takes a deduction in one year but recovers in a subsequent year some or all of the amount that gave.

The tax benefit rule is covered by section 111 of the Internal Revenue Code.

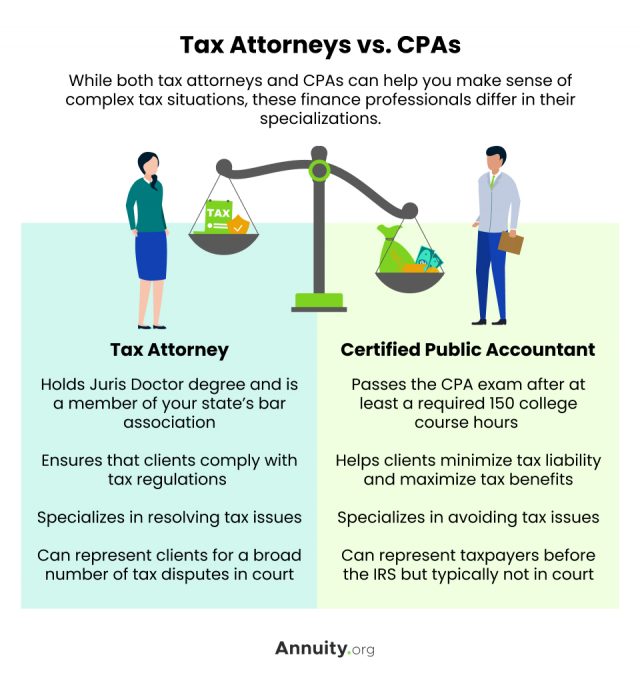

Tax Attorney When To Get One And What To Look For

Communication Informs About New Irs Rule On Pre Tax Health Insurance Premium Contributions For Pastors Church Workers News

Foreign Earned Income Exclusion And Us Or Irs Tax Returns

Build Back Better Bill Would Build A Bigger But Not Better Irs Bureaucracy The Heritage Foundation

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

:max_bytes(150000):strip_icc()/tax-documents-to-the-irs-3973948-0d372f2897a34944abb220e99cca25ce.jpg)

How To Mail Your Taxes To The Irs

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Where Is My Tax Refund 2021 How Long Does Irs Take To Process Taxes

Publication 554 2021 Tax Guide For Seniors Internal Revenue Service

Irs Applies Special Tax Benefit Rule To Publicly Traded Stock Wealth Management

Irs Announces New Standard Deductions For 2023 Forbes Advisor

The Complete 2022 Charitable Tax Deductions Guide

Banks Are Wrong To Fight Proposed New Irs Disclosure Rule Bloomberg

2022 Tax Inflation Adjustments Released By Irs

Irs Reminds Employers Wellness Incentives Are Taxable

Acct 440 Welcome To Taxation Of Business Entities Dr Efrat Ppt Download

Irs Final Rule On Minimum Value Innovative Benefit Planning

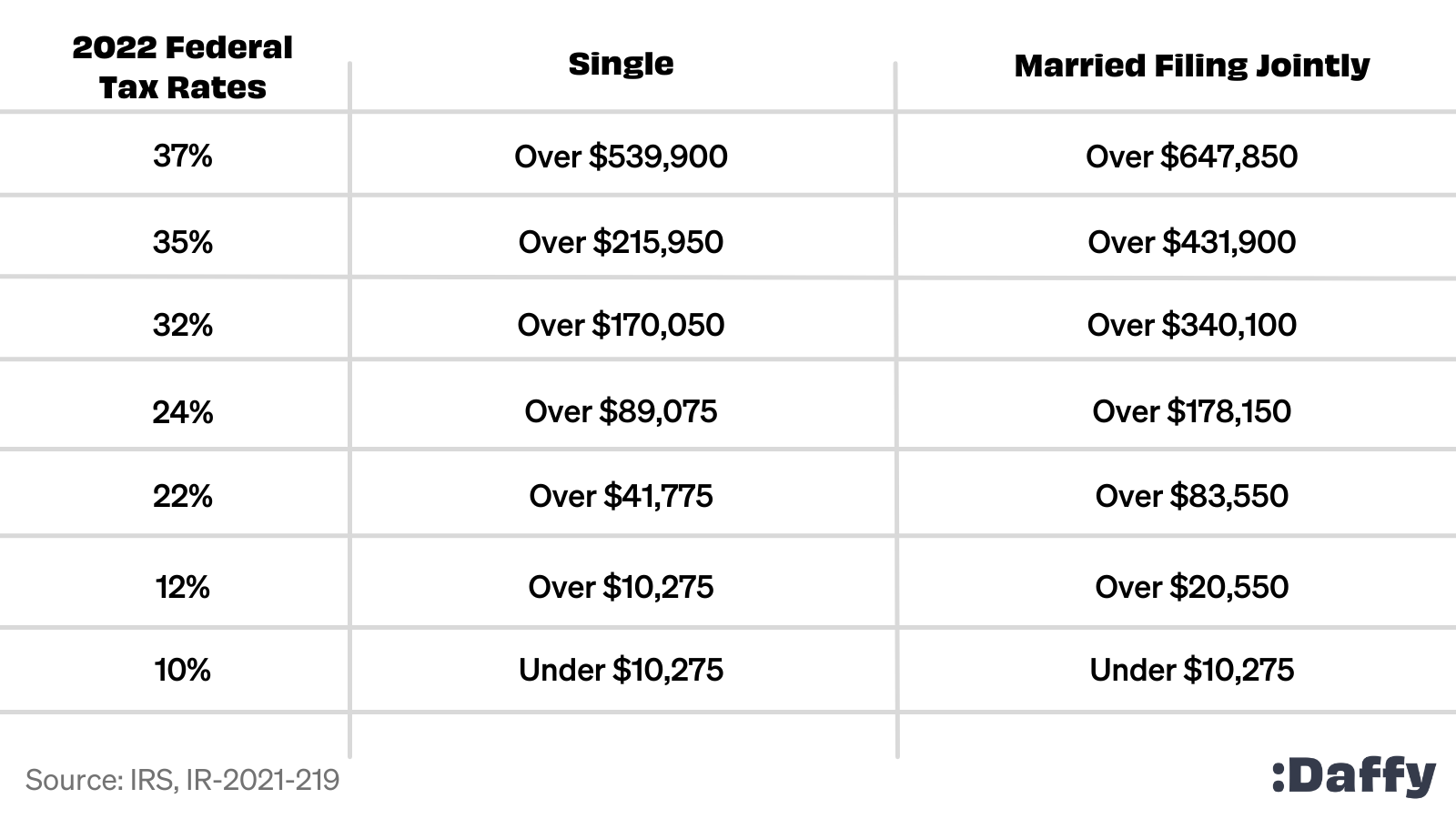

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More